5 Tips for New Business Owners

Disclosure: This post contains affiliate links, meaning I get a commission if you make a purchase through my links, at no cost to you. However, I only recommend products I use and love.

In 2013, when I quit my full-time job to start my own business, I hadn’t discovered podcasts or figured out that Pinterest is a great resource for finding others fempreneurs who paved the way before me. I was basically a cavewoman, taking it one day at a time.. with no idea what I was doing. Here are 5 things I wish someone had told me before I started my business!

1. Identify Your “Why”

It really doesn’t matter what your “why” is, as long as it motivates and inspires you. To be honest, starting a business never really felt like a choice for me but rather what I had to do. I worked full time as a graphic designer for a few companies before starting my business and I wasn’t fulfilled. The work wasn’t creative enough, I wasn’t doing brand identity work, which is my passion, and I hated being on someone else’s schedule. Not to mention I have ADHD so focusing 8 hours a day on someone else’s vision was super challenging for me.. and kinda boring.

I told myself back then that I didn’t care if I was poor and had to eat Cup of Noodles for every meal.. I just wanted the FREEDOM to do work I loved, on my own schedule, to help other entrepreneurs bring their ideas to fruition, and to make enough money to get by. My current WHY is pretty much the same, except I have much bigger financial goals now than in my 20’s.

I remind myself of my WHY when I feel frustrated by a slow month of sales or a client who is a pain the ass. When I remind myself of my WHY, I remember how truly fortunate I am.. and I feel so grateful. My business has allowed me to live a life I LOVE, in New York City (aka the most expensive place on earth)… and I don’t even have to eat shitty junk food noodles, although I still do occasionally because they’re nostalgic.

PRO TIP: WRITE DOWN YOUR WHY and keep it somewhere you can see it every day. I love a neon post-it for this.

2. Don’t Wait for Perfection to Launch

The biggest mistake I see so many people make is waiting for something to be perfect before launching. Drop the perfectionist mindset, you just have to get the ball rolling. Keep in mind, you can (and should) evolve as you go. You might feel like you aren’t ready, and that’s okay.

There is no “right time,” there is just time and what you choose to do with it.

Are you waiting to start because you don’t have any clients? Sorry, not an excuse.

If you’re a photographer, take pictures of your friends for their social media accounts and request that they give you credit / tag you so that other people can discover you.

Are you a newly certified lash artist and you need to build up a client base? Do lashes for free on your friends and make sure you get some great photos of your work so you can start to promote your biz on Instagram! (Added bonus, your friends might fall in love with their lashes and come back as paying customers.)

Take advantage of any opportunity to practice your skills while simultaneously creating awesome portfolio pieces or content that will attract paying clients.

3. Use Quickbooks Accounting Software - seriously do not wait on this one!

Back in the day I used to keep track of my accounting on an Excel spreadsheet and make my own invoices. It was a nightmare and I get anxiety just thinking about it. Since 2016 I have been using Quickbooks to my own accounting, which I absolutely love. QB makes it super easy to record everything, I have peace of mind that the math is done perfectly, and nothing slips through the cracks. I also love the reports feature, so I can compare how I’ve done from one year compared to another. Do not waste money on a professional accountant, get Quickbooks instead.

4. Keep Your Overhead Low

I have seen people make this mistake time and again.

An eager entrepreneur starts a new business. They hire a team of employees, rent a beautiful office in a trendy neighborhood, and assume that if they build it, clients will come. Unfortunately that is not usually the case, and I have seen those people crash and burn in a matter of months.

Take the opposite approach and keep your overhead low. I’ve chosen 3 areas to focus on:

1. EMPLOYEES vs. Subcontractors

Your number one focus in the beginning should be building a solid client base, rather than building a dream team. Do as much of the work yourself as you possibly can. For me that includes not just designing projects for clients, but also sales, accounting, managing my social media, content creation, and of course design. Wear as many hats as you need to so that your business is profitable. I recommend doing this for as long as you can possibly stand it. It takes time to grow a small business. Like anything worth having, it won’t happen overnight and you have to be patient.

When you reach the point where you are so busy that you absolutely cannot do everything yourself, THEN find people to outsource tasks to. Don’t hire someone full-time, or even part-time, until you absolutely need that much help. Use subcontractors instead! I occasionally hire trusted freelance designers to take on easier projects when my workload is more than I can handle. I pay them by the hour or by the project for the work they do, rather than giving them a part time or full time position. This will save you a ton of $$ because you’re only paying for the help you actually need.

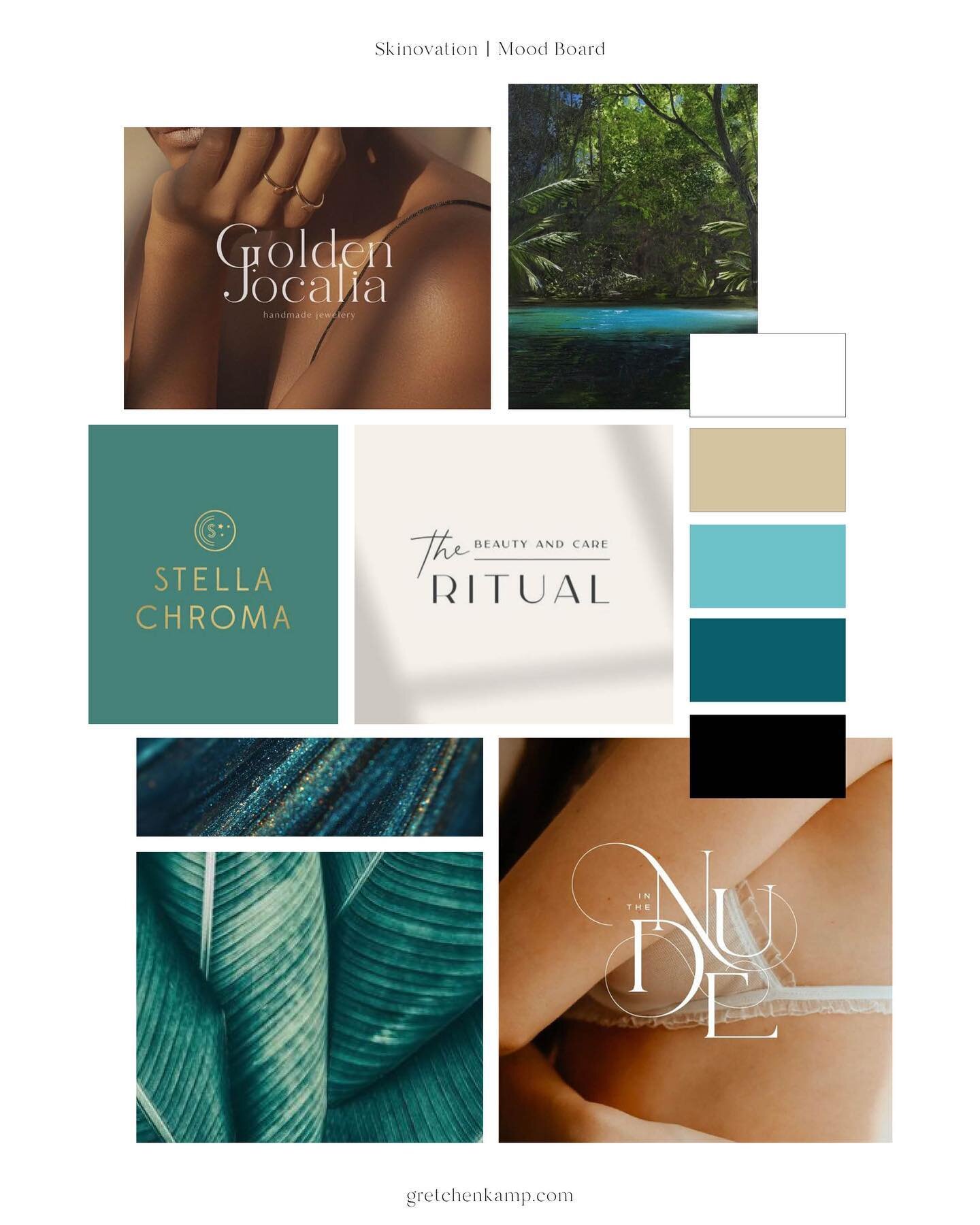

Pro tip: Use Canva Pro to design graphics if you can’t afford to hire a professional designer just yet. I would never recommend using Canva for your logo, but it’s a great tool for everything else! When you’re ready, let’s chat about professional branding & web design. 😉

2. workspace

Another way you can keep your overhead low is to minimize the cost of your workspace. If possible, work from home! Especially since Covid, WFH has become so normalized that no one will question your professionalism just because you’re working from your dining room table.

I realize not everyone has the option to work from home, but you DO have a choice in how much you spend on your space. Really take some time to think about what you need from the space and then decide how much it’s worth to spend. Is foot traffic essential to your business? For a fashion boutique, yes. For a spa? Maybe. For a photographer or graphic designer? Probably not.

Personally I think co-working spaces (such as WeWork) are a huge ripoff. They start around $500 a month for an unassigned desk, and you can get the same experience for free in any decent coffee shop. If the coffee shop is too distracting, in my experience most restaurants don’t mind if you post up with a laptop.. as long as people aren’t waiting for tables and you order a meal while you’re there.

SUBSCRIPTIONS & miscellaneous expenses

Look at all your business expenses and figure out if there’s anything you’re spending money on that you don’t really need. For almost a year I had a subscription with istockphoto.com. I was paying several hundred dollars a month for unlimited downloads of stock photography. It’s a fantastic resource.. but when I looked at how many images I was actually downloading each month, I realized I could save a ton of money by using free stock photo websites instead (pexels.com, unsplash.com) and occasionally purchasing individual images from istock, but only when I really need them.

5. Save $ Before Your Quit Your Day Job

I learned this one the hard way, and I don’t want you to repeat my mistake. THIS IS PROBABLY THE MOST IMPORTANT OF ALL.. but its not as sexy as the others which is why I’m putting it last.

When I left my full time job in 2013 to pursue a freelance career, I had $500 in the bank. YIKES! I had a handful of clients and I was (naively) confident that I could keep myself busy with enough work to pay the bills. And I did, for one whole year. Then in February of 2014, I had a very slow month with practically no sales. I felt hopeless and I remember crying myself to sleep every night for a week because I felt so low. I didn’t have any savings to fall back on, so I had to find a full time job, fast. I was very luckily hired almost immediately by a fantastic company, San Diego Magazine and I worked there for 9 months.. while still freelancing every night and weekend so I could continue to grow my freelance biz and eventually go back to freelancing full time.

While I was working at the magazine, I saved $10,000. I don’t remember where I got that number, but at the time, my rent was about $800, my bills were very small, I didn’t spend much on clothes or food, and I knew that $10K would be enough to keep me afloat for at least a few slow months.

Figure out based on your lifestyle and monthly expenses how much money you need to save before quitting your full time job. I recommend enough to cover your cost of living for at least 6 months. A year is better, but I know that can be challenging. Even if you’re slammed now, I promise there will be ebbs and flows and you do NOT want to HAVE to take the first job you can find on Craigslist!

Save enough $$ to cover your cost of living for at least 6 months to a year, before quitting your day job

Pro Tip: Don’t let your profits define your self-worth. When you have a slow month, don’t mope around or feel bad for yourself. As tempting as it may be, resist the urge to binge watch Housewives of New Jersey for 6 days straight.

Take advantage of the extra time you have and use it to do personal portfolio projects, write blog posts, take a Jenna Kutcher marketing course, or create badass content for Pinterest that will drive traffic to your website.

Did you enjoy this blog post? You’ll love my emails. Click here to subscribe!

I’m a Brand Designer and Strategist living in NYC. 9 years ago I quit my job to start this business, and now I’m here to help you do it too! I specialize in helping established female millennial entrepreneurs transform their brands.. to attract Dream Clients and grow their businesses, so that they can make more money, be their own bosses and live the life they deserve!